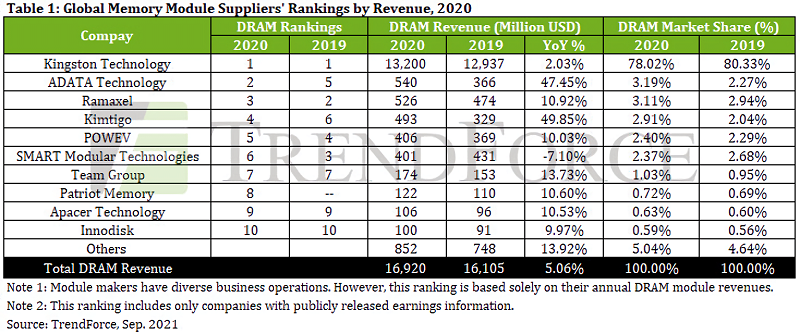

In brief: As with some many industries, DRAM manufacturers had a profitable 2020 thanks to the increased demand for laptops and desktops, a result of so many people suddenly working and learning from home. Sitting on top of the pile was Kingston, again, which grabbed a massive 78% of the entire market.

According to TrendForce’s report, notebook shipments increased by 26% YoY in 2020. That, combined with a jump in desktop shipments, meant a corresponding increase in DRAM demand. Module revenue was up about 5% YoY to $16.9 billion, improving on the $16.1 billion from 2019.

Kingston, maker of the HyperX brand, dominated the list of top manufacturers. The $13.2 billion in DRAM module revenue it generated in 2020 equated to a market share of 78%. Despite increasing its revenue by about 2% YoY, Kingston lost some market share last year compared to 2019, albeit by just -2.33%. TrendForce writes that the company adopted a relatively conservative sales strategy during 2020 in response to uncertainties in the pandemic-influenced market.

For comparison, second place Adata Technology managed $540 million in revenue, taking just 3.19% of the market. The Taiwanese company’s revenue from DRAM module sales to was up 47% YoY, thanks to the move to WFH, distance learning, and its entry into the gaming segment. But it didn’t experience the largest yearly growth; that honor went to Shenzhen-based Kimtigo, whose module business grew 50%, helping it jump from sixth place to fourth.

The only company in the top ten that saw its revenue shrink was Smart Modular Technologies. TrendForce puts the -7.10% YoY decline down to the fact it sells most of its products in the US and South American countries such as Brazil, locations that have been hit hardest by the pandemic.